Not quite sure what a Heath Savings Account (HSA) is? Looking for more information on how to get the most out of your HSA? Whether you are new to the WORD team or an old pro, it’s important to know how to get the most out of your HAS account!

What is an HSA account?

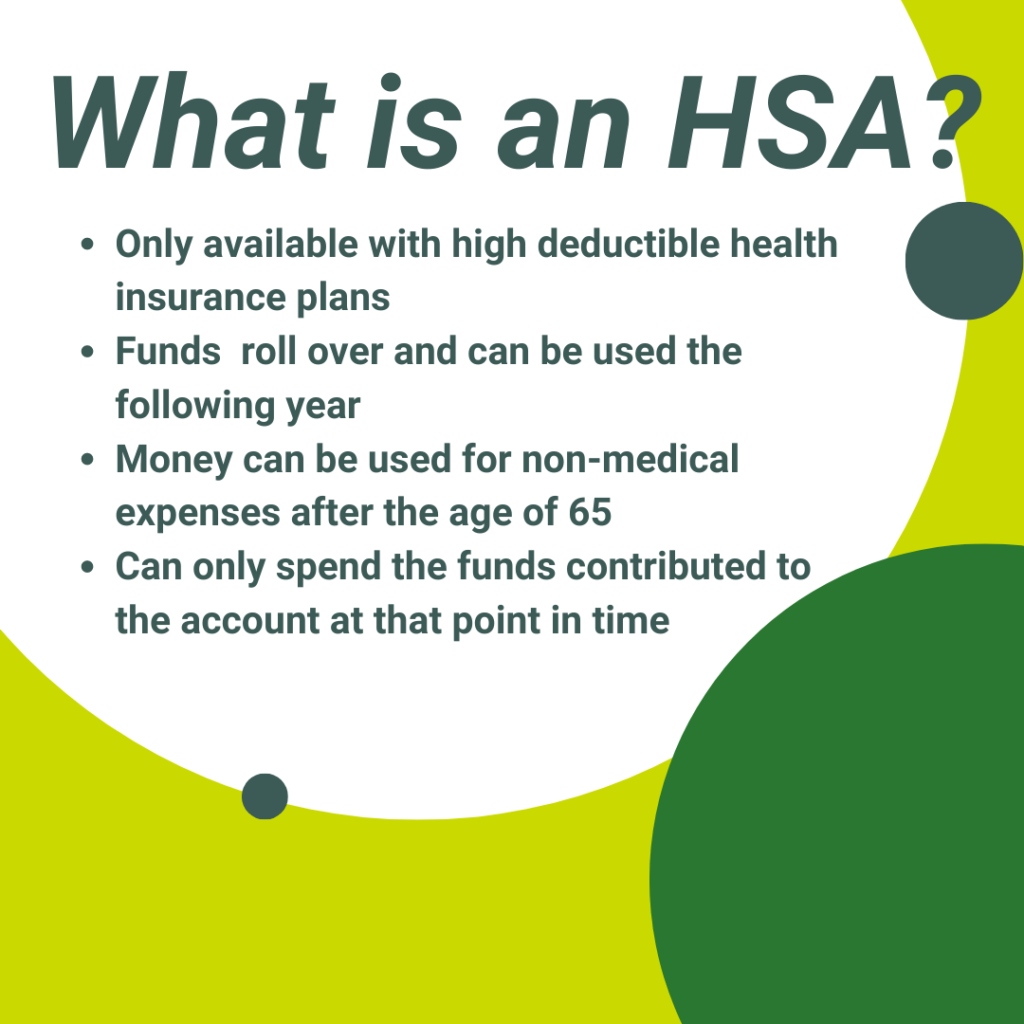

Let’s start with the basics, what is a Heath Savings Account (HSA)? An HSA is essentially a personal savings account that can be used to pay certain health care costs. This account allows you to make contributions and withdraws tax-free, as long as you use it for qualified medical expenses. To be eligible for an HSA you must be enrolled in a high deductible medical insurance plan, like what is provided at WORD Rock Drills. With a typical high deductible health plan, the monthly premium is lower, however, you pay more healthcare cost upfront before your insurance will kick in.

What can I use my HSA account for?

Now that you know what an HSA account is, what can you use this money for? When you first get started at HSA Bank you will be issued a debit card for your HSA account. This debit card ties directly into the money you have contributed and the card can only be used for qualified medical expenses. There are a variety of medical expenses that fall under this umbrella. The most common expenses are listed below:

- Doctor’s office visits and co-pays

- Drug prescriptions

- Vaccines

- Over-the-Counter Medications

- Dental treatments (including X-rays, cleanings, fillings, sealants, braces, and tooth removals)

- Eyeglasses (Rx and reading)

- Ambulance

- Chiropractor

Find the FULL list of qualifying expenses HERE.

Can my family use my HAS account?

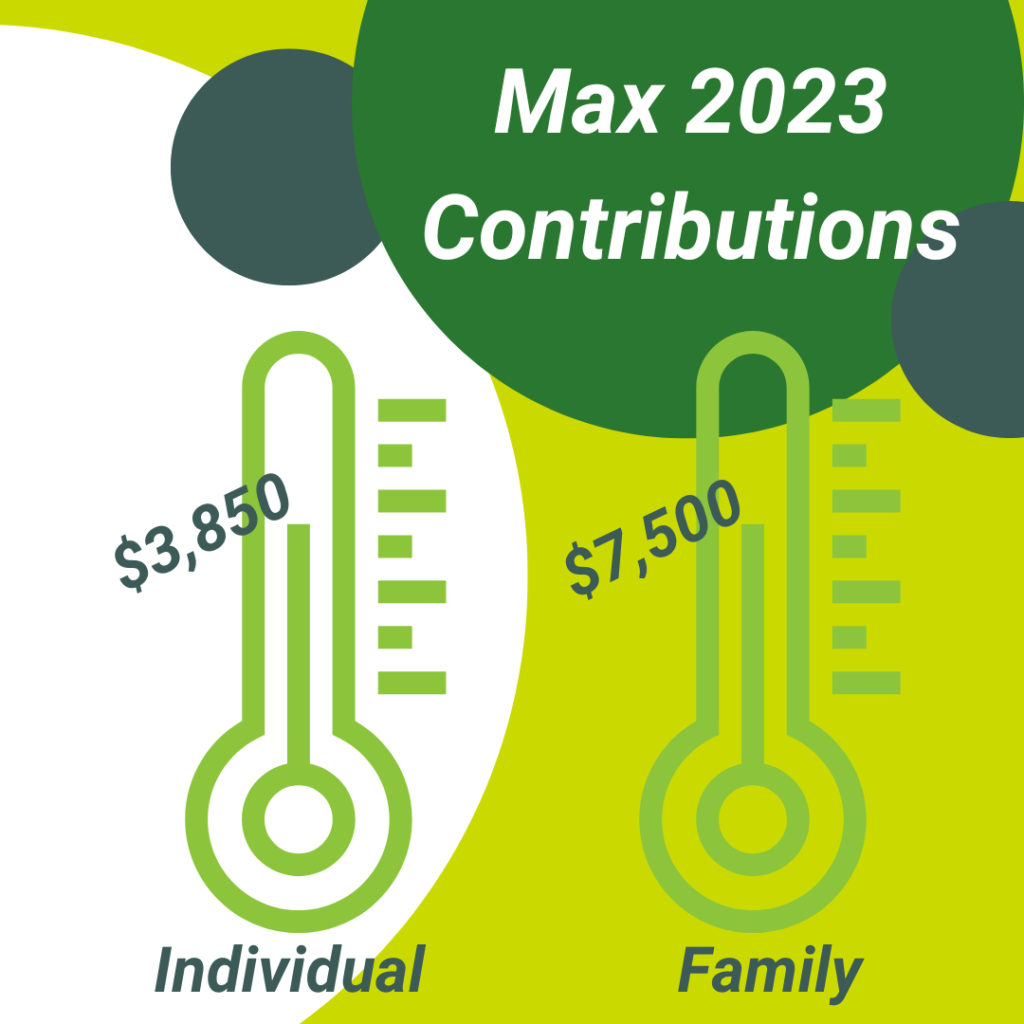

When setting up your HSA you have the option to choose an individual or family account. Choosing a family account allows you to contribute more money into the account each year tax-free while the individual contribution maximum is normally half of the family amount. Regardless of the status of your account, your HSA can be used to pay for qualifying medical expenses for your dependents. However, we would suggest that you set up your account as a family account if you intend to use it in this manner in order to maximize the value of the account.

How can I contribute to my HSA?

Depending on the insurance plan you choose, WORD will contribute up to $— per month to your HSA account. If you choose to register your account as a family account, the WORD contribution will remain the same, however, you can increase your personal pre-tax contributions to have more available in the account to use on your dependents. The maximum contributions 2023 contributions for individuals is $3,850 and family is $7,750.